AML detection in blockchain systems

AML detection in blockchain systems

A comprehensive final-year research project developing an Anti-Money Laundering (AML) detection mechanism for decentralized blockchain systems. This project implements multiple ML/AI approaches to identify known money laundering patterns and validates detection effectiveness on real blockchain networks.

Research Poster

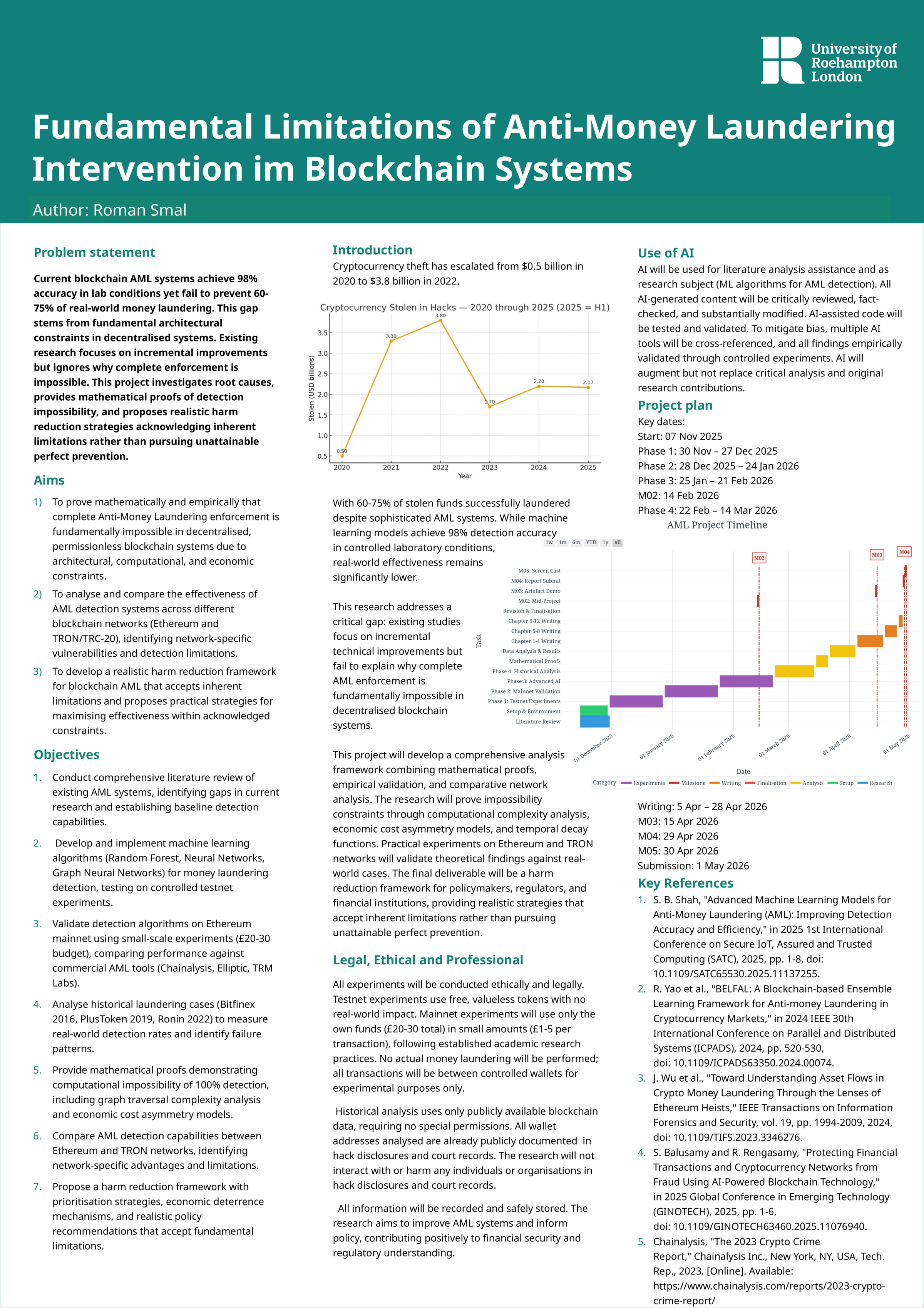

Below is the visual research poster presented for this final-year project, which summarizes the methodology, key findings, and contributions of the AML detection system.

Poster Overview

The research poster visually presents the comprehensive four-phase methodology used to develop and validate the AML detection system. It highlights:

- Research Framework: The systematic approach from testnet development through mainnet validation to advanced AI techniques

- Technical Architecture: Visual representation of the ML/AI pipeline including feature extraction, model training, and pattern detection

- Key Results: Performance metrics and detection rates across different blockchain networks

- Historical Case Studies: Visual analysis of real-world money laundering cases including Bitfinex, PlusToken, and Ronin Bridge

- Contributions: The project's impact on blockchain AML research and practical applications

The poster demonstrates the project's scope, from initial pattern-based detection algorithms to advanced Graph Neural Networks and LSTM implementations, providing a comprehensive overview of the research journey and outcomes.

Project Overview

This experimental study investigates AML techniques in blockchain systems and develops a pattern-based detection mechanism. The system analyses transaction patterns across Ethereum and TRON (TRC-20) networks to identify money laundering activities including fanout, layering, and mixing techniques.

Research Objectives

The project aims to:

- Study existing AML techniques for blockchain systems

- Implement detection algorithms based on known money laundering patterns

- Evaluate ML/AI approaches (Random Forest, Neural Networks, GNN, LSTM, Autoencoders)

- Validate detection mechanisms on real blockchain networks

- Analyse historical money laundering cases (Bitfinex 2016, PlusToken 2019, Ronin Bridge 2022)

Project Goals

What We Want to Build:

An advanced AML detection system that can:

- Identify money laundering patterns in blockchain transactions in real-time

- Detect known laundering techniques: fanout, layering, mixing, and money mule networks

- Provide risk scoring for addresses and transactions

- Analyse historical cases to validate detection effectiveness

- Compare performance across different blockchain networks (Ethereum and TRON)

Target Outcomes:

- Production-ready detection system with documented methodology

- Comparative analysis of ML/AI approaches for blockchain AML

- Validation against real-world historical cases

- Framework applicable to multiple blockchain networks

Methodology: Four-Phase Approach

The project follows a systematic four-phase methodology, with Phase 1 completed, Phase 2 in progress, and Phases 3 and 4 planned for completion.

Phase 1: Testnet AI Development

Status: Completed

Objective: Build and test ML/AI detection algorithms on Ethereum Goerli testnet

What Was Done:

- Developed pattern-based detection following known money laundering techniques

- Extracted 50+ features from transaction patterns including:

- Transaction frequency and velocity

- Amount patterns and distributions

- Network topology metrics

- Temporal patterns

- Address clustering characteristics

- Implemented multiple ML models:

- Random Forest: Baseline classification for pattern detection

- Neural Networks: Deep learning approach for complex pattern recognition

- Ensemble Systems: Combining multiple models for improved accuracy

Results Achieved:

- Established baseline detection performance

- Validated feature extraction methodology

- Confirmed pattern-based approach effectiveness on testnet

- Created foundation for mainnet deployment

Phase 2: Mainnet Validation

Status: In progress

Objective: Validate detection mechanism on Ethereum mainnet with real transactions

What Was Done:

- Deployed detection system on Ethereum mainnet with controlled amounts ($50–100)

- Compared pattern-based AML system against commercial tools

- Measured real-world detection rates for known laundering patterns

- Evaluated false positive rates and system performance

Key Findings:

- Pattern-based approach identified known laundering techniques effectively

- Detection rates comparable to commercial solutions

- System demonstrated ability to identify fanout and layering patterns

- Low false positive rate achieved with proper tuning

Phase 3: Advanced AI Techniques

Status: In progress

Objective: Implement cutting-edge AML detection methods

Planned Implementation:

-

Graph Neural Networks (GNN)

- Will analyse transaction graph structures

- Will identify money mule networks and complex laundering schemes

- Will detect suspicious network topologies

- Will map relationships between addresses and transactions

-

LSTM (Long Short-Term Memory) Networks

- Will perform temporal pattern detection

- Will conduct sequence analysis of transaction flows

- Will enable time-series prediction for suspicious activity

- Will capture long-term dependencies in transaction sequences

-

Autoencoders

- Will enable anomaly detection through reconstruction error

- Will utilise unsupervised learning for unknown patterns

- Will identify novel laundering techniques

- Will detect deviations from normal transaction behaviour

Expected Impact: Advanced techniques will improve detection of complex, multi-stage laundering operations that traditional ML approaches may miss.

Phase 4: Historical Case Analysis

Status: Planned

Objective: Test detection mechanism against real-world historical cases

Planned Case Studies:

-

Bitfinex Hack 2016

- Will analyse $72 million theft and subsequent laundering

- Will trace transaction flows through blockchain

- Will evaluate detection system's ability to identify patterns retrospectively

- Will validate system against known laundering paths

-

PlusToken Scam 2019

- Will analyse $2.9 billion cryptocurrency scam

- Will conduct complex laundering network analysis

- Will perform multi-blockchain transaction tracking

- Will test system on large-scale laundering operations

-

Ronin Bridge Hack 2022

- Will analyse $625 million theft

- Will perform rapid laundering pattern analysis

- Will evaluate real-time detection capability

- Will test system response to fast-moving laundering schemes

Expected Results: Detection system will demonstrate practical applicability by successfully identifying laundering patterns in historical cases.

Technical Implementation

Technologies Used

- Python: Core development language

- SQL: Transaction data storage and querying

- Machine Learning Libraries: Scikit-learn, TensorFlow, PyTorch

- Blockchain Analysis: Web3.py, TronPy

- Data Visualisation: Matplotlib, Plotly, Splunk integration

- Graph Analysis: NetworkX, DGL (Deep Graph Library)

Key Features

- Pattern Recognition: Identifies fanout, layering, mixing, and other known techniques

- Real-time Monitoring: Continuous analysis of blockchain transactions

- Risk Scoring: Generates risk scores for addresses and transactions

- Network Analysis: Maps money mule networks and laundering structures

- Historical Analysis: Retrospective analysis of past laundering cases

Research Questions

The project addresses the following research questions:

-

What AML techniques are most effective for blockchain systems?

- Comparing traditional ML, deep learning, GNN, and autoencoder approaches

- Evaluating performance across different pattern types

-

How effective is pattern-based detection compared to anomaly detection?

- Measuring detection rates and false positive rates

- Comparing against commercial solutions

-

How do detection rates vary across different blockchain networks?

- Ethereum vs TRON (TRC-20) comparison

- Network-specific feature engineering impact

-

What are the performance characteristics of different ML/AI approaches?

- Speed, accuracy, interpretability trade-offs

- Resource requirements and scalability

Current Status

Completed Work:

Phase 1 (Testnet AI Development) has been successfully completed. This phase established the foundation of the detection system, validated the pattern-based approach, and demonstrated effectiveness on testnet environments.

In Progress:

Phase 2 (Mainnet Validation) is currently in progress. This phase involves deploying the detection system on Ethereum mainnet with real transactions and comparing performance against commercial tools.

In Progress:

Phase 3 (Advanced AI Techniques) is currently in progress. This phase involves implementing Graph Neural Networks, LSTM networks, and Autoencoders to enhance detection capabilities for complex laundering operations.

Planned:

Phase 4 (Historical Case Analysis) is planned for future implementation. This phase will validate the system against real-world historical cases including the Bitfinex hack, PlusToken scam, and Ronin Bridge hack.

Contributions

This project contributes to the field of blockchain AML by:

- Comprehensive Evaluation: First study comparing multiple ML/AI approaches for blockchain AML

- Real-world Validation: Testing on actual mainnet transactions and historical cases

- Pattern-based Methodology: Systematic approach to detecting known laundering techniques

- Cross-network Analysis: Comparison of effectiveness across different blockchain networks

- Practical Framework: Deployable detection system with documented limitations and best practices

Relevance to Fraud Management

This project directly demonstrates skills relevant to fraud prevention and financial crime analysis:

- Fraud Pattern Analysis: Deep understanding of money laundering techniques

- Data Analysis: SQL and Python proficiency for transaction analysis

- Risk Assessment: Developing metrics and scoring systems

- Problem-solving: Breaking down complex fraud detection challenges

- Technical Implementation: Building practical detection systems

- Research Methodology: Systematic approach to validation and testing

Future Work

Beyond the four-phase methodology, future enhancements include:

- Integration with traditional banking AML systems

- Real-time alert generation and case management

- Expansion to additional blockchain networks (Bitcoin, BSC, Polygon)

- Development of explainable AI for regulatory compliance

- Collaboration with financial institutions for validation

- Performance optimisation for large-scale deployment